The Fed: Tapering, not tightening - and not yet

The Fed is making every effort to remain accommodative and supportive of the economy and financial markets. Repeatedly, Powell went out of his way to remind investors that policy normalization will be gradual, that tapering is not tightening, and tapering does not signal the beginning of a Fed tightening cycle anytime soon. As we move into the mid-cycle stage, we look to diversify our sector outlook and for a normalization in growth rates for the economy and corporate profits. We also suggest investors focus on quality as volatility may create ripples in equity markets in the coming months.

Federal Reserve chairperson Jerome Powell spoke today at the 2021 Economic Policy Symposium at Jackson Hole. His speech was titled “Macroeconomic policy in an uneven economy”. Given the uneven nature of this recovery, the Fed chair gave a somewhat dovish speech and made it clear that policy adjustment (higher policy rates) is a long way off. On the issue of tapering he suggested that a plan may be announced soon and that tapering could begin after that. The good news is that there is a big difference between the tapering of quantitative easing and the beginning of broader monetary policy normalization. In fact, Powell said that “the timing and pace of the coming reduction in asset purchases will not be intended to carry a direct signal regarding the timing of interest rate liftoff, for which we have articulated a different and substantially more stringent test”.

In his speech, Powell addressed the uneven nature of the recovery but also pointed out that the economy and financial markets are healthy and once again suggested that inflation will normalize as supply rises to meet demand. For financial markets this message was well received. From our perspective, equities should benefit as the Fed Chair made it clear that rate tightening will only come after the tapering is concluded. Equities should also benefit from the reopening and the fact that the Mr Powell said the Fed will provide support to the economy as long as is needed to achieve a full recovery. Earnings are forecast to rise in excess of 20 per cent in the second half of the year and about 10 per cent per year in the next two years.

Therefore this speech is supportive for growth and earnings. From a sector perspective, cyclical and interest rate related companies should benefit from the combination of above-trend growth and low interest rates. We remain positive on financials, real estate, and technology with an eye on quality value opportunities as the services sector continues to reopen. Finally, this low rate structure should make income investors take a serious look at quality dividend yielding stocks.

For fixed income markets, tapering could affect rates on the margin but we do not expect US interest rates to rise meaningfully as a result of this shift in policy. In fact, the initial reaction in the bond market was a small rise in inflation expectations but a fall in real yields, bringing the Treasury yields lower by a few basis points. Global remand for US Treasuries remains solid as USD13 trillion of global sovereign debt remains in negative yielding territory. Moreover, with the new US fiscal year beginning in October it is widely believed that next year’s deficit could be much lower than this year. With less debt there would be reduced issuance of Treasuries, which should keep them well bid and interest rates low. This bullish outlook should also be positive for high yield and emerging market bonds. For the US dollar this environment of flat rates is a headwind for any sharp appreciation but we think USD will see some mild support due to the slowing global economy, the slower upside for equity market and the yield differential with the euro.

The Fed & and the economy

Fed Chair Powell stated that while the recovery has been uneven it remains quite strong. Economic growth probably peaked in the second quarter, but should remain well above trend for many quarters to come. While the rebound in economic activity has been quite healthy, millions remain unemployed and the unemployment rate at 5.4 per cent in July remains well above levels in the pre-Covid economy.

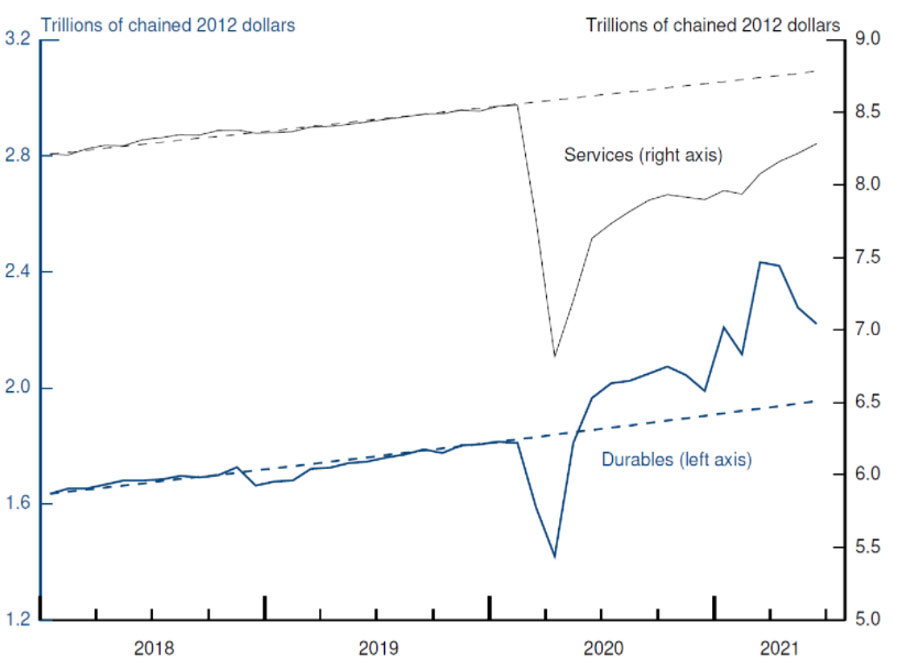

Spending on durable goods increased during pandemic

Consumer spending: Durable Goods vs. Services

Note: The data are monthly estimates of real personal consumption expenditures and extend through June 2021. Trend spending is shown by the dased lines and is constructed using the average growth rates from January 2018 to January 2020

Source: US Bureau of Economic Analysis as of 27 August 2021

In addition, many homeowners and renters remain at risk with the termination of the eviction moratorium. According to a recent Census Bureau survey report 3.5 million people, or 6% of renters nationwide, are “likely” to face eviction in the US. In addition, Powell pointed to the dramatic shift in consumer spending patterns as during the recession and recovery consumers increased spending on goods, particularly durable goods such as appliances, furniture, and vehicles. They shifted “away from services, particularly in-person services in areas such as travel and leisure”. This trend is reversing quickly as the economy reopens and vaccination rates rise. However , it is important to remember that spending on services remains about 7% below trend based on Fed calculations. Despite the healthy gains in labor markets, total employment remains 6 million people below it’s February 2020 level, of which 5 million of those jobs are in the still-reopening services sector. All of these points argue for a gradual approach to policy normalization.

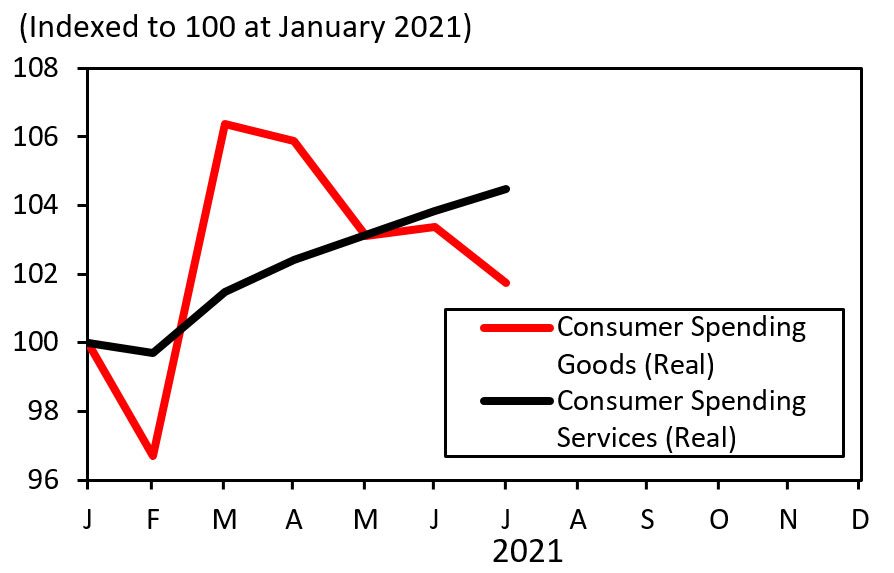

Reopening lifting services spending

Consumer spending: Goods vs Services

Source: Bloomberg, HSBC Private Banking as at 27 August 2021

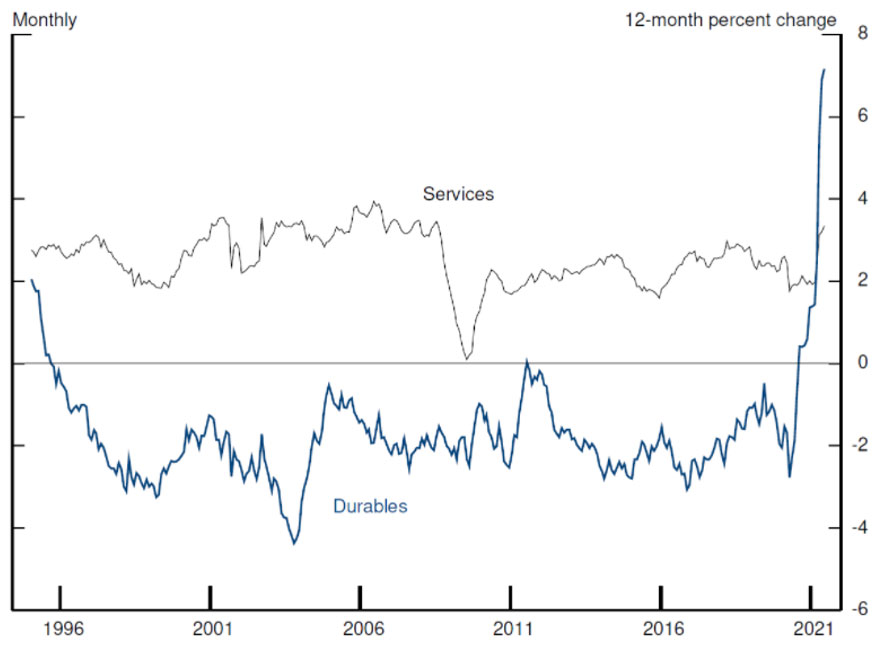

However, Mr Powell noted that with “vaccinations rising, schools reopening, and enhanced unemployment benefits ending, some factors that may be holding back jobseekers are likely fading”. This could ease some of the labour shortages, which is important as employment gains should remain healthy for the foreseeable future. The Fed Chair acknowledged that inflation has been higher than anticipated, but suggested that longer-term inflation expectations should still be well contained. The Fed remains confident that broad-based inflation indicators should head back towards the FOMC’s 2% symmetric target rate as supply rises to meet demand.

Durable goods inflation has run far below that of services for 25 years before the pandemic

PCE Deflators: Services and Durables

Note: The data are price deflators for personal consumption expenditures and extend through June 2021.

Source: US Bureau of Economic Analysis as of 27 August 2021.

Investment Summary

The key takeaway from this policy conference for financial market participants is that the Fed is making every effort to remain accommodative and supportive of the economy and financial markets. That said, the Fed has also recognized that the time to begin to normalize some monetary policy, especially in the area of long-term interest rates, is no longer necessary nor productive. Repeatedly, Mr Powell went out of his way to remind investors that policy normalization will be gradual, that tapering is not tightening, and tapering does not signal the beginning of a Fed tightening cycle anytime soon.

In equity markets, we may not see continued multiple expansion but equity indices should rise in line with earnings as inflation subsides. However, as the business cycle in the US matures, we look to diversify our sector outlook and for a normalization in growth rates for the economy and corporate profits. We also suggest investors focus on quality as volatility may create ripples in equity markets in the coming months. In addition, income investors may look to equity markets in the US and Europe as companies lift dividend policies or become dividend payers, given the large corporate cash stock piles. For fixed income investors, tapering should not lift the US Treasury yield curve materially and as the economy continues to stay healthy, those in search of better yields should look to high-yield and emerging market credits for opportunities. Once again, quality should guide a selective approach to these markets.