Unlocking opportunities

Our world is evolving: the changes happening in global economies and societies represent new avenues for growth and innovation. While all opportunities come with their own risks and uncertainties, some ESG and sustainable investing thematics offer strong investment potential. Integrating these considerations into an investment approach provides a pathway for investors to capture new opportunities that are underpinned by global trends. Here are three examples:

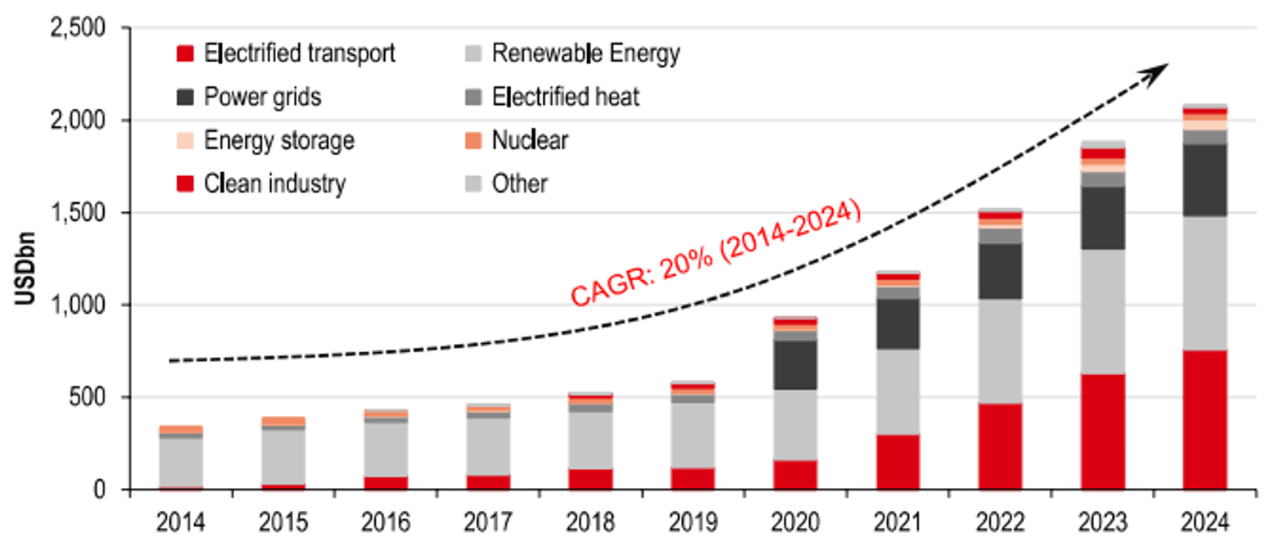

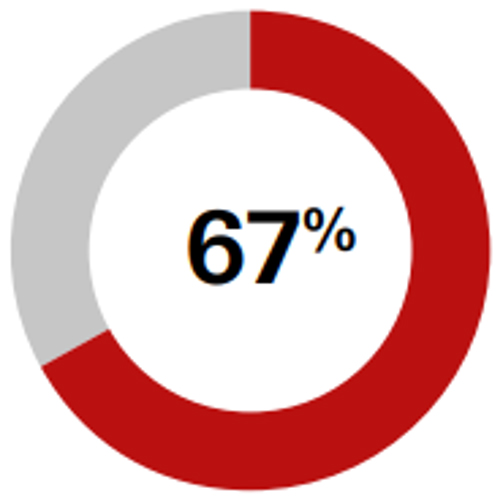

a) Energy Transition: The transition to clean electrification (including renewables, nuclear, grids etc.) is becoming essential as electricity demand surges globally, driven by demographic shifts, AI advancements, and electrification. For governments worldwide, facing the challenges of ensuring national energy security and affordability, while striving for sustainability, this increasingly involves optimising the use of locally sourced sustainable energy. Investors can make the most of opportunities in this landscape, with electric power demand projected to soar by 75 per cent by 2050. Solar, wind, and other renewables are set to meet 67 per cent of global electricity needs, doubling their share from 2024. (HSBC Private Bank Investment Outlook Q4 2025). S&P Global Commodity Insights projects there will be up to USD60 trillion in energy investment opportunities by 2050 under a net-zero scenario (source)

-

Figure: Global Energy Transition Investment Growth (2014-2024)

Source: BNEF; Other includes Hydrogen, CCS and Clean Shipping

Demand for electric power is estimated to rise 75 per cent by 2050, driven by economic development, EVs, cooling and data centres

Solar, wind and other renewables may meet 67 per cent of the world's electric demand by 2050, doubling the share in 2024

Clean energy equipment is now half the price compared to a decade ago, making a compelling economic case for energy transition

Source: BNEF New Energy Outlook 2025, IEA World Energy Investment 2025, HSBC Private Bank as at 4 September 2025.

b) Circular economy and biodiversity: By 2030, the circular economy could unlock USD4.5 trillion of global growth by transforming supply chains and reducing waste through closed-loop systems that replace the 'take-make-dispose' model (Research Report). By embracing themes such as circular economy, recycling and resource longevity, investors can potentially unlock new opportunities, as companies that integrate these considerations tend to better preserve the biodiversity that underpins resilient ecosystems and long-term value creation

c) Healthcare and social empowerment: Global demographic changes are reshaping healthcare and workplace culture. Rising healthcare costs and aging populations demand solutions that deliver improved outcomes and cost-effectiveness. Meanwhile, studies1 show that companies with gender-diverse or ethnically diverse leadership teams are more likely to achieve above-average profitability. Companies with strong workforce experiences (as laid out by Deloitte as the sum of a human’s lived experiences at work and how they feel about their organisation) are 1.6x more likely to achieve customer outcomes and enjoy 25 per cent greater profitability

The importance of diversification remains paramount when considering any investment strategy. Investors who pursue ESG and sustainable investing opportunities can mitigate the risks specific to these strategies by risk-sizing their thematic allocations or by balancing exposure across sectors and regions to avoid biases, in a similar fashion to traditional investment approaches.

/uplift-images/banner/Baling%20River%20bridge%20Anshun%20China%20-%20Banner.jpg)

Build a resilient investment portfolio

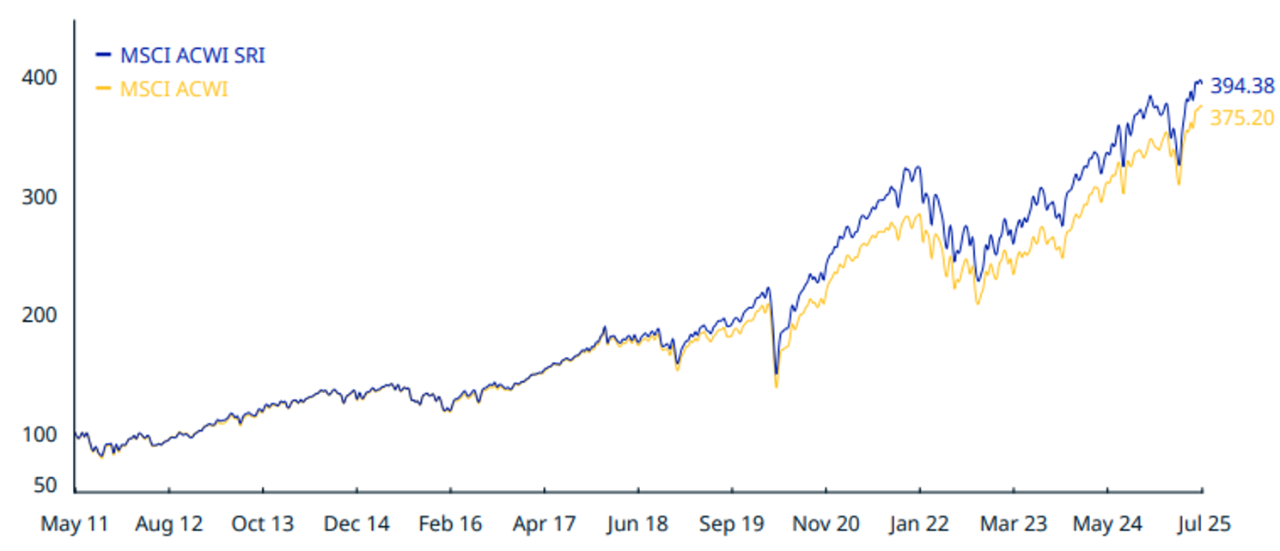

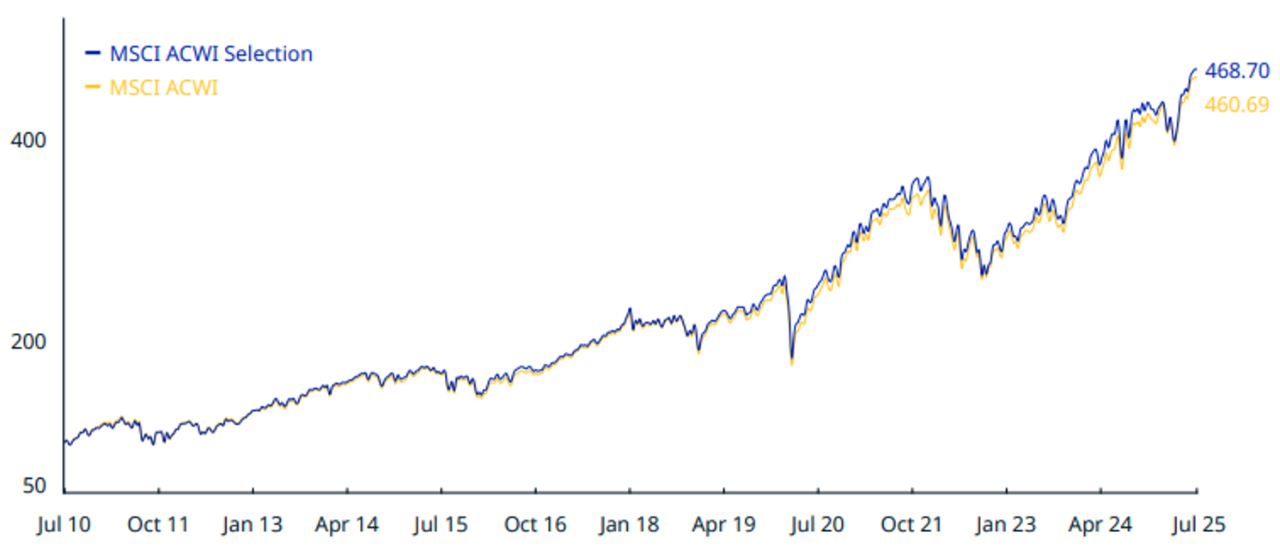

Our Analysis shows that investing in companies with strong ESG practices and following a broad-based and diversified approach can make an investment portfolio more resilient over the long-term.

Why is it the case? Companies with strong ESG profiles are better equipped to manage longer-term risks, such as climate change, regulatory shifts, and social issues. These companies benefit from lower capital costs and operational efficiency, which in turn improve stakeholder relationships, resilience to global economic shocks, and overall business performance.

Figure 1 below shows equity benchmarks representing companies with robust ESG profiles against the broader global equity markets. By observing the historical performance, we can see that broad-based and diversified ESG portfolios were well-positioned to capture upside potential while maintaining resilience against market downturns:

-

Figure: ESG indices have performed in line with the markets over the long term2

CUMULATIVE INDEX PERFORMANCE – GROSS RETURNS (USD)

(MAY 2011 – JUL 2025)

CUMULATIVE INDEX PERFORMANCE – GROSS RETURNS (USD)

(JUL 2010 – JUL 2025)

-

- MSCI ACWI Index: Represents large and mid-cap stocks from developed and emerging markets worldwide

- MSCI ACWI SRI Index: Represents global stocks with strong ESG ratings, excluding those with negative social or environmental impacts

- MSCI ACWI Selection Index: Selects stocks from MSCI ACWI based on ESG criteria and sector weights, excluding those with ESG controversies or involvement in specific business activities

- For more info refer MSCI publications here and here

To learn more about ESG and sustainable investing, please speak with your HSBC relationship manager or investment counsellor.

1 Social empowerment outcomes may vary and are influenced by changing social contexts and company level practices; results are not uniform for all investors or communities. ↩

2 ESG index historical performance is provided for illustrative purposes only and does not represent a guarantee of future results; market conditions and methodologies may differ. ↩

Integrating ESG in a diversified portfolio

This section is not applicable to clients/prospects serviced by the following booking centres: HSBC Private Bank (Suisse) SA, HSBC Private Bank Luxembourg SA and HSBC Private Bank (Luxembourg) S.A. French Branch

Our sustainable investing approach starts with understanding your financial objectives.

We see three main ways to embed sustainability into an investment portfolio, which can be applied across portfolio allocations:

HSBC Enhanced: Investment solutions that seek stronger ESG performance, through either setting a minimum ESG score, favouring high performers, or excluding low performers in its investment approach.

What are some examples?

Single line equities and bonds issued by a company that has:

- An MSCI Environmental Pillar Score and Social Pillar Score within the top ranking amongst all issuers. For example within the top 10 per cent either in the Emerging Market or Developed Market group, OR

- Already reached, or is close to reaching, its sector’s decarbonisation targets, OR

- Strong plans and targets to decarbonise and is on track with its emission reductions

Single line bonds issued by a company that gets a lot of their income (for example at least 30 per cent) from products and services aligned that are:

- Aligned with a theme that references a recognised industry framework, like the UN Sustainable Development Goals (UN SDGs)

- Aligned with a Climate theme, such as: Renewable energy (e.g. solar, wind).; Energy transition (e.g. switching from fossil fuels to cleaner energy).; Energy efficiency (e.g. efficient building or appliances); Cleaner transportation (e.g. electric vehicles, public transit)

The above excludes companies which either:

- Have a low ranking for Governance pillar score within the investment universe (for example bottom 20 per cent MSCI Governance Pillar Score), OR

- Earn significant revenue from adult entertainment, gambling, alcohol (for example higher than 50 per cent from either of these) OR

- Earn revenue from tobacco production (for example greater than 0 per cent), OR

- Are involved in significant controversies (for example Sustainalytics score is 5), OR

- Fail key sustainability and ethical considerations, such as:

- High emissions (for example, bottom 5 percentile),

- High energy consumption (for example, bottom 5 percentile),

- Harm to biodiversity or water (for example, bottom 10 percentile),

- Hazardous waste (for example, bottom 10 percentile),

- Violations of international standards such as UN Compact Principles,

- Gender pay gaps (for example, bottom 5 percentile),

- Poor board diversity (for example, less than 10 per cent), OR

- Involvement with banned weapons.

Single line bonds issued by a government that makes a positive contribution, such as performing well on UN Sustainable Development Goals (SDGs) or leading on climate change action. This excludes countries which either:

- Are under sanction, OR

- Has high corruption (for example, Corruption Perception Index <34), OR

- High carbon emissions (for example bottom 5 percentile), OR

- Poor social outcomes (for example, countries rated low in Human Development Index), OR

- Does not have good governance (for example, MSCI Governance Pillar score is less than or equal to 3)

A fund that excludes issuers in the bottom ranking of its investment universe end (by way of example, the bottom 20 per cent). They’ll be measured based on their relevant ESG metrics, such as ESG rating or carbon intensity compared relative to their peers.

A fund that aims to invest in a portfolio with a higher weighted ESG rating than the reference market benchmark rating. Issuers who are low ranked (based on their ESG scores) won’t meet the benchmark.

A fund that aims to deliver improvement in carbon-related measures (for example a 30 per cent or more) compared to market benchmark to manage carbon emissions.

A fund with measurable ESG improvement targets for its underlying holdings, and with an action plan to address where improvements aren’t being achieved.

HSBC Thematic: Investment solutions that focus on sustainability themes, sectors, or growth areas such as decarbonisation, energy transition, healthcare or climate tech, for example, aligning with the themes of the UN Sustainable Development Goals.

What are some examples?

Single line equities issued by a company that gets a lot of their income (for example at least 30 per cent) from products and services aligned that are:

- Aligned with a theme that references a recognised industry framework, like the UN Sustainable Development Goals (UN SDGs)

- Aligned with a Climate theme, such as: Renewable energy (e.g. solar, wind); Energy transition (e.g. switching from fossil fuels to cleaner energy).; Energy efficiency (e.g. efficient building or appliances); Cleaner transportation (e.g. electric vehicles, public transit)

The above excludes issuers which:

- Have a low ranking for Governance pillar score within the investment universe (for example bottom 20 per cent MSCI Governance Pillar Score), OR

- Earn significant revenue from adult entertainment, gambling, alcohol (for example higher than 50 per cent from either of these) OR

- Earn revenue from tobacco production (for example greater than 0 per cent), OR

- Are involved in significant controversies (for example Sustainalytics score is 5), OR

- Fail key sustainability and ethical considerations, such as:

- High emissions (for example, bottom 5 percentile),

- High energy consumption (for example, bottom 5 percentile),

- Harm to biodiversity or water (for example, bottom 10 percentile),

- Hazardous waste (for example, bottom 10 percentile),

- Violations of international standards such as UN Compact Principles,

- Gender pay gaps (for example, bottom 5 percentile),

- Poor board diversity (for example, less than 10 per cent), OR

- Involvement with banned weapons.

A fund that invests most of its net assets in issuers, and that gets a lot of its revenues (for example at least 20 per cent) from products and services aligned with an ESG theme.

A fund that invests in issuers with defined and measurable ESG thematic objectives that can be identified and monitored.

A fund that has its own way to assess progress against an ESG theme through its investments. This will be made up of a clear framework, methodology and a way to check against metrics strongly aligned with the theme.

A fund with a climate change strategy that follows climate goals in line with the Paris Climate Agreement, which aims to limit global warming to well below 2 degrees Celsius above pre-industrial levels and to pursue efforts to limit the increase to 1.5 degrees Celsius. It should be clear how the fund monitors its exposure and meets this climate theme.

HSBC Purpose: Investment solutions that seek to deliver intentional, positive and measurable outcome(s) and align to a predefined objective, measured using key performance indicators or established impact measurement frameworks.

What are some examples?

- a green, social or sustainable bond issued by a company or government. Its proceeds are used to help transition to a sustainable business model, or an ESG project with clear metrics

The following are excluded:

Bonds issued by a company are excluded if they:

- Have a low ranking for Governance pillar score within the investment universe (for example bottom 20 per cent MSCI Governance Pillar Score), OR

- Earn significant revenue from adult entertainment, gambling, alcohol (for example higher than 50 per cent from either of these) OR

- Earn revenue from tobacco production (for example greater than 0 per cent), OR

- Are involved in significant controversies (for example Sustainalytics score is 5), OR

- Fail key sustainability and ethical considerations, such as:

- High emissions (for example, bottom 5 percentile),

- High energy consumption (for example, bottom 5 percentile),

- Harm to biodiversity or water (for example, bottom 10 percentile),

- Hazardous waste (for example, bottom 10 percentile),

- Violations of international standards such as UN Compact Principles,

- Gender pay gaps (for example, bottom 5 percentile),

- Poor board diversity (for example, less than 10 per cent), OR

- Involvement with banned weapons.

Bonds issued by a government are excluded if they:

- Are under sanction, OR

- Has high corruption (for example, Corruption Perception Index <34), OR

- High carbon emissions (for example bottom 5 percentile), OR

- Poor social outcomes (for example, countries rated low in Human Development Index), OR

- Does not have good governance (for example, MSCI Governance Pillar score is less than or equal to 3)

A fund that invests most of its net assets in issuers with products or services that aim to create a positive and measurable ESG-related impact. For example, investing linked to achieving UN Sustainable Development Goals (UN SDGs), such as climate change or gender diversity.

To support our clients in their sustainability journey, we offer a full range of ESG, sustainable and impact investing products:

Managed Solutions

Sustainable investing funds, ETFs, discretionary mandates & alternatives investments

Capital Markets

Fixed Income (such as Green, Social, Sustainability, Sustainability-Linked bonds), Equities, Structured Products

Research & Insights

Comprehensive coverage of ESG insights publications

Group Solutions

Access to commercial banking, global markets and asset management capabilities

HSBC Group Industry initiatives

2001

Joined the UK Sustainable

and Finance Association

2006

Signatory to the Principles

for Responsible Investment

2007

Joined Institutional Investors Group on Climate Change

2015

Signatory to the Montreal Carbon Pledge

2017

Launched ClimateAction100+ initiative in collaboration with other investors

2019

Founding member of One Planet Asset Manager Initiative supporting the One Planet Sovereign Wealth Fund Working Group

2020

Founding signatory of the Finance for BiodiversityPledge

2021

Founding member of Finance to Accelerate the Sustainable Transition infrastructure (FAST- Infra) Signatory of the Net Zero Asset Managers Initiative

HSBC Group Awards & Recognition

HSBC is committed to publishing regularly updated information on its ESG performance. The achievements have been recognised in receipt of awards including:

Best ESG Technology Offering – Private Bank

(Private Banker WealthTech Awards 2024, 2025)

Best Private Bank for ESG Technology

(PWM Wealth Tech Awards 2024)

Winner of Impact Investing – Private Bank (Pan-Asia & Greater China)

(WealthBriefingAsia & Greater China Awards 2024, 2025)

Most innovative ESG offering by a Private Bank

(Private Bank Innovation Awards 2024, 2025)

Best for ESG Investing in Taiwan

(Asiamoney Private Banking Awards 2023)

Best bank sustainability offering (investments)

(WealthForGood Awards 2023, 2025)

Best ESG private bank in Hong Kong

(Asset Asian Awards 2023)

ESG Investing Product/Services Excellence Award

(Bloomberg Bizweek 2022, 2023, 2025)

HSBC Global Research

Award winning Climate Change Centre of Excellence since 2017

‘Middle East’s Best Bank for Sustainable Finance’

(Euromoney, 2019, 2020, 2021)

Improved MSCI ESG rating to AA

(‘ESG Leader’, recognising our strong corporate governance and commitment to sustainable finance 2021)

‘Asia’s Best Bank for Sustainable Finance’

(Euromoney, 2019, 2020, 2021, 2022, 2023)

The Digital Banker Global Sustainable Finance Awards 2025

⠀

Glossary list

Environmental

Environmental refers to the natural world, and includes matters related to Climate (net zero, transition risk, physical risk) and Nature (natural capital, ecosystem services and biodiversity).

Governance

Governance refers to a set of rules and principles defining and the management and oversight of a company. It can be used interchangeably with corporate governance.

Social

Social refers to the consideration of people and relationships, and includes Human Rights and Labour Standards.

Sustainability

Sustainability is a broad term that refers to the ability of an activity, practice, or entity to meet the needs of the present without compromising the ability of future generations to meet their own needs. Environment, Social and Governance (“ESG”) are the three main dimensions of sustainability.

Sustainable Development Goals (SDGs)

The 17 Sustainable Development Goals (SDGs) were born at the United Nations Conference on Sustainable Development in Rio de Janeiro in 2012. The objective was to produce a set of universal goals that meet the urgent environmental, political and economic challenges facing our world.

/uplift-images/banner/bridge-across-water-in-china.jpg)