Discover how you can use your investment policies to demonstrate how your charitable and financial objectives are aligned.

by Sophie Ward

Where to begin?

With stakeholders increasingly focused on how charities are using their finances to not only support their charitable objectives, but to be a force for good, sustainable investment is of growing relevance from both a fiduciary and charitable perspective.

Concern about our collective impact on the planet and the people around us is growing. As the global economy evolves to address sustainability issues, it creates opportunities and risks for companies. Organisations that most effectively manage these should be better positioned from a fiduciary perspective.

A good starting point when it comes to incorporating these considerations into your investment policy is to think about your objectives and purpose. Understanding what you are looking to achieve from a financial and a sustainability perspective, and the interaction between the two, is key.

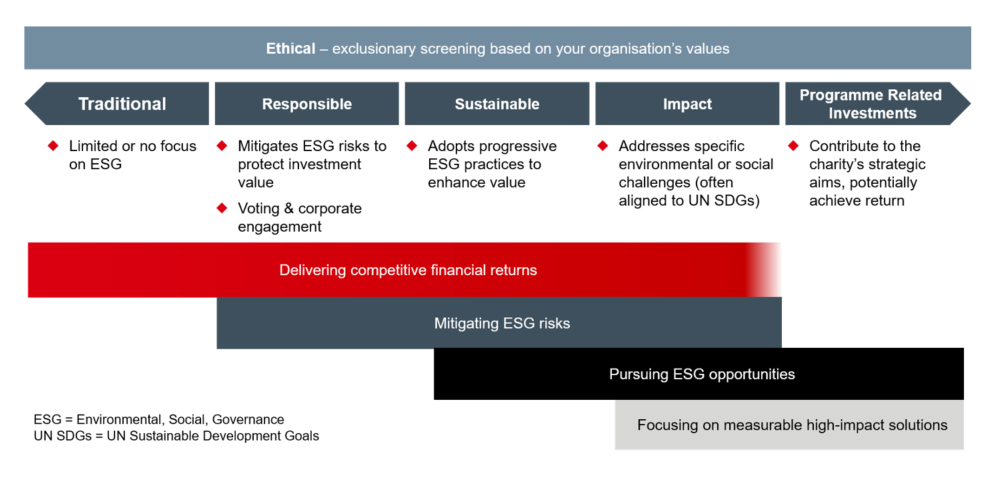

The Spectrum of Capital The Spectrum of Capital defines the interaction between an investment focus on financial returns and environmental and societal matters. It can help you identify where your organisation might fall on the spectrum and what else you may need to consider.

Source: Adapted from Bridges Capita HSBC Private Banking, Social Impact Investment Taskforce: Asset Allocation Working Group

Six key questions to ask:

- What are your organisation’s objectives?

- What are your ethical restrictions?

- What are your responsible investment requirements?

- What are your sustainable investment requirements?

- What is your expected interaction with your investment managers and how will you assess them?

- How are you going to report back to stakeholders?

It is crucial to understand why you are seeking to incorporate sustainability criteria. This may include reasons such as:

- To further your charitable objectives

- To take your stakeholder views into consideration

- To enhance your financial returns

Understanding your objectives will help you define what you are looking for in your investments, provide greater clarity on your priorities – both financial and non-financial - and the direction of travel you’re working towards.

Ethical restrictions use exclusionary screening based on your values. For example, avoiding certain sectors such as; fossil fuels, tobacco, alcohol.

- What values you are trying to implement?

You may want to consider the views of your beneficiaries and stakeholders and what your charitable objectives are.

Establishing this will likely lead to debate. A way of assessing the views of the trustees is for everyone to rank them independently to encourage discussion.

Being able to articulate why you are excluding certain sectors, business activities or companies is important for stakeholders to be able to understand decisions.

- Clarification of exclusions

Defining the breadth of an exclusion will be important to enable implementation, and for you to monitor compliance with your investment policy.

As an example, if implementing a tobacco exclusion is it just tobacco producers; or does it include retailers selling tobacco products and companies involved in the supply chain process? What level of involvement would you deem to be necessary to be excluded?

Terms such as ‘avoiding investments contrary to the charity’s aims’ should be defined more precisely.

- Implementation of exclusions

You will need to be able to define how you want to implement any restrictions you place on your portfolio.

Assessing the involvement of a global company in a particular business activity requires data, which isn’t always available, so the more specific an exclusion is, the more detailed the data behind it will need to be. Working with your investment manager to understand what data is available will be an important part of implementation.

You will also need to decide on what turnover level of business involvement you deem to be acceptable – often it may be 10 per cent, but you may decide on any exposure. Again, this will be data dependent, so you will need to establish what matters to you and what your manager is able to implement.

When investing through funds or indirect investments, it will be harder to define any restrictions, so understanding what your investment manager is doing within these will be crucial.

As an example, removing oil and gas stocks reduces the opportunity for engagement to help these companies transition to greener energy.

Adding ethical restrictions to your portfolio could mean reducing your investable universe. Understanding the potential impact of this will be important, both from a financial and sustainability perspective.

There is no right or wrong answer, but it’s important as trustees that you understand the financial impact of your decisions.

You should have a robust discussion with your investment manager on your requirements and document the agreed approach, with an understanding of how the charity will monitor it.

Responsible investment is an approach to investing that incorporates Environmental, Social and Governance (ESG) factors into investment decisions, to better manage risk and generate sustainable, long-term returns. It includes Active Ownership, which is the active use of the rights of ownership to influence corporate behaviour.

Activities may include directly engaging with the company, filing shareholder proposals and voting. You should outline your expectations around whether ESG integration should take place in your portfolio and any expectations around voting and engagement.

- Voting, engagement, and policy activities

Here it is key to understand what activity your investment manager is undertaking on your behalf. If you want to direct votes yourself, you may need to consider your custody structure and investments.

Questions to ask may include:

- Does your manager have access to company management? How are they engaging with portfolio companies? What success can they show?

- Are their voting and engagement activities made public?

- Are they members of policy organisations? Do they actively engage? These may include Principles for Responsible Investment (PRI), Climate Action 100+, UK Stewardship Code, Institutional Investors Group on Climate Change

- Do they actively engage with regulators and policy makers on systemic sustainable investment issues?

- Do they support frameworks to enhance company disclosure?

Sustainable investment covers investment methods which focus on investing into companies with progressive sustainability practices.

- Articulation

You should be able to articulate any particular areas of sustainable investment that your charity is concerned with and why. Is this aligned to the charity’s mission, or something more general? For example, you may be focused on a specific social consideration in line with your objectives, or be more broadly concerned with climate change.

- Implementation considerations

It will be important to understand how you expect these sustainable investment requirements to be implemented. Assessing progress towards sustainability ambitions in large global companies has pitfalls, such as relying on data and output from the company itself. The future direction of travel of the company will be important, as well as historical data.

Data points may include ESG scores, with the two largest providers being MSCI and FTSE Russell, which use different scoring methodologies. Investment managers will often have in-house ratings as well.

You may decide to review based on a reduction in carbon intensity, top sector performers for a specific social or environmental issue or overall performance and progress. Companies are increasingly reporting on their alignment to the UN Sustainable Development Goals and other positive measures.

There are various ways to review and assess the sustainability of investment portfolios, so understanding how your charity will do so is key.

- What is the financial impact?

Understanding the financial impact of any sustainability focus includes asking questions such as:

- Do you expect it to improve long-term returns?

- If you are investing in a climate or sector focused fund does this increase the concentration risk of the portfolio, and potentially make it more volatile?

- How do the investments fit with your fiduciary requirements?

- What is the impact on income?

Investment managers have different ways of implementing ethical, responsible and sustainable criteria. They will also likely be doing a lot of underlying work on your behalf, in line with their fiduciary responsibility. You should therefore seek to understand:

- What is their responsible investment policy?

- What methods do they use and what do they stand for?

- Do they vote and engage?

Portfolio reviews are a crucial time for you to discuss and challenge activity:

- Can they explain why holdings support your objectives?

- What kind of support and sustainability reporting can they provide? Are there additional costs to this?

- Do they think that your risk and return metrics are achievable when combined with other ethical and sustainable parameters?

- Have you considered the ESG factors of the investment manager themselves? For example, their gender diversity and environmental impact

Finally, consider how you are going to measure success against the policy and inform your stakeholders about it. This may include receiving information from your investment manager or reporting on your activities within your annual report.

There are a lot of big decisions to make in this space, but the first step is to start the dialogue and seek advice from trusted advisors. Establishing your direction is critical, with investment policies often evolving over time.

The Charities Commission (at the time of writing) will be releasing further guidance on Responsible Investment.

If you would like to discuss further please contact HSBC Charities & Education team.

Example in annual report

Our investments are managed by HSBC Private Banking. They implement our ethical investment policy by:

- Excluding direct exposure to tobacco, alcohol and gambling

- Taking Environmental, Social and Governance risks into account

- Investing sustainably by improving the ESG score and reducing the carbon intensity of the portfolio when compared to a market comparator

They utilise the responsible investment expertise of HSBC Global Asset Management, which has 3 responsible investment pillars:

- Integration of ESG considerations throughout the investment process

- Considering active ownership through voting and engaging with portfolio companies. In 2020 ESG issues were raised in engagements with over 2,300 companies and other issuers in 78 markets. They voted on more than 86,000 resolutions at over 8,200 company meetings across 70 markets, representing 96 per cent of the ballots at which they were entitled to vote

- Working with policymakers and industry leaders to support the transition to a low-carbon economy, such as ClimateAction100+