Embedding Purpose into a Business Exit

The exit stage of business ownership is often framed as the final hurdle of the journey. It is here that entrepreneurs must carefully weigh up competing priorities prior to a sale, succession or buy-out. For purpose-driven entrepreneurs, the stakes are particularly high, as it is the final opportunity to make a positive impact through their businesses and determine their legacies for clients, staff and families.

It is not always easy to translate intention into action. It becomes harder still once the exit process begins and negotiations are layered with complexity.

To be effective, purpose-driven entrepreneurs should ensure that alignment on values is front and centre of their search for a buyer or successor. They should take care to build resilience into their succession plans to secure what they leave behind. And they should remember not to lose sight of their personal priorities as they choose their next role.

Bring values to the heart of the exit process

For many entrepreneurs, valuations will be the driving force building up momentum in the exit process. But 'Seller's Remorse' is commonplace, with those who have sold their businesses rarely saying the process went perfectly. Frequently-expressed regrets include wishing there had been more time to plan or consider different options.

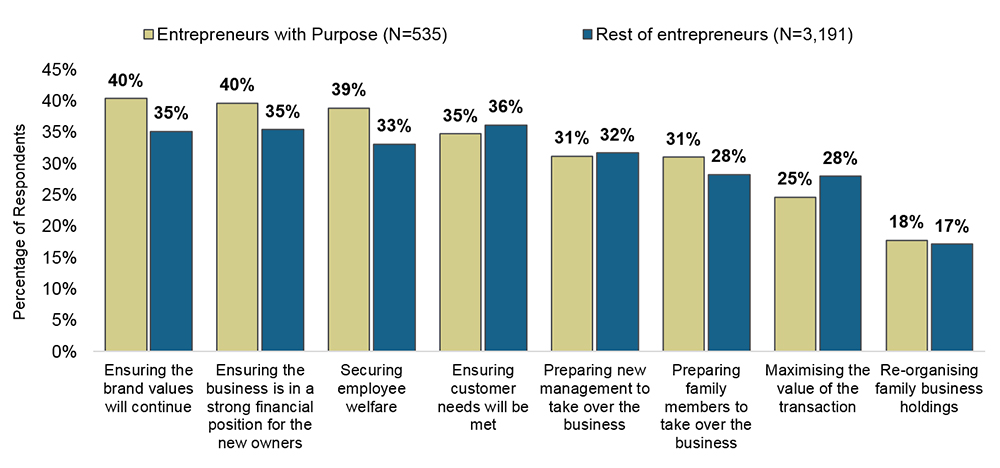

Purpose-driven entrepreneurs will feel the same pressures but are also more worried about what will happen to the businesses once they have stepped away. HSBC Private Bank's proprietary Essence of Enterprise research shows their preoccupations during exit include securing employee welfare, securing the financial position of the firm for the new owners and ensuring brand values continue [Figure 1].

Figure 1: Purpose-led entrepreneurs focus more on their staff during a business exit

Q: What would you say are your main business priorities for a successful exit?

Source: HSBC Private Bank, Essence of Enterprise

With such a wide range of priorities, it is critical to be upfront both with advisors and potential buyers about these objectives and bring alignment on values to the heart of the search process.

Russell Prior is Head of Family Governance and Family Enterprise Succession at HSBC Global Private Banking. He cautions: "Most business owners want to do the right things when looking at their exit strategy. But you have to be clear about your objectives and negotiate from there, otherwise the objectives can compete with each other and cause confusion. For example, a strategy to look after employees (and protect jobs in the local community where they are employed) may be less likely to maximise value on exit."

Being transparent about values before getting into the negotiation can influence the structures put in place. Russell points to the example of Julian Richer, the founder of Richer Sounds, who was able to set up an employee ownership trust to protect his staff and offer them majority ownership.

Enhance the resilience of the business to support its longer-term success

Resilience has become the watchword of entrepreneurship in the COVID-19 era, with many owners regretting that their businesses were not better prepared to withstand the unprecedented pressures. HSBC's Navigator research indicates that nearly half (47 per cent) admit they could have done more to prepare for shocks and over a third (35 per cent) did not invest in the technology in the past two years that might have supported them through this crisis.

With exit plans likely to be delayed in the current environment, there is an opportunity to improve resilience and secure longer-term success. This could include introducing flexible working policies to support staff, for example; or better use of technology and making supply chains more sustainable.

Such investments should help exiting founders to put their businesses on a stable footing and, as Russell explains, a robust business also gives potential sellers a stronger hand in negotiations. "Sustainability and good governance are becoming critical considerations. Buyers are rightly looking at these factors to evaluate the business's 'success formula'."

In reality, life 'after exit' begins long before

Business exits are often emotionally charged, unsettling and protracted negotiations. Once the transaction is done, many entrepreneurs find it difficult to completely step away from their ventures.

For those who have been motivated by purpose, however, this is rarely the end. The progression towards exit is not linear and even in the midst of economic turbulence, entrepreneurs will go on to set up new ventures or invest in side opportunities in parallel with their current interests.

As Russell points out: "The old model of an entrepreneur working, selling then becoming charity-focused doesn't really exist anymore. Entrepreneurs increasingly tend to weave impact into their professional and business careers and once they exit, want to do something meaningful with their surplus wealth."

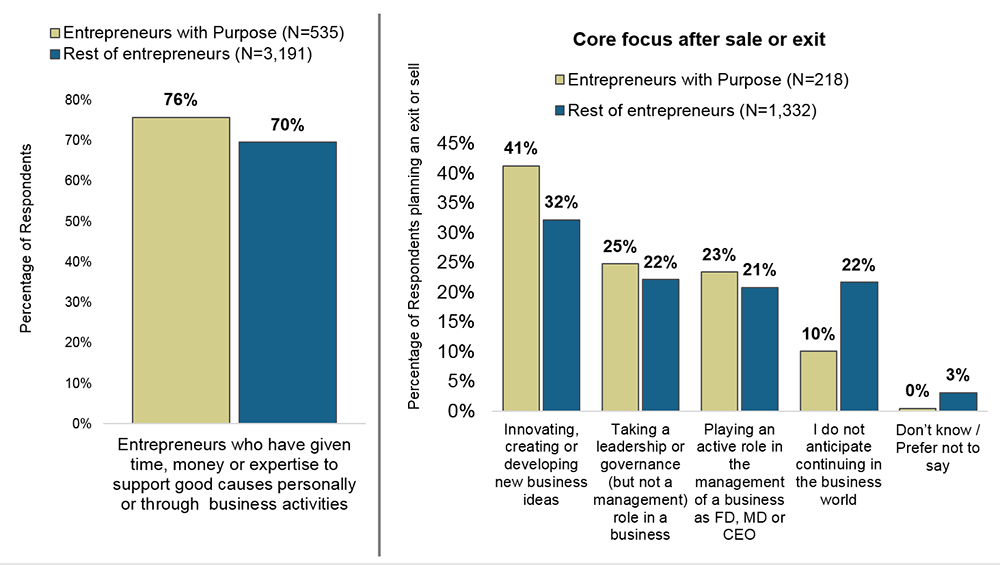

At the same time, they should be prepared to think about the kind of purpose-driven role that would bring personal fulfilment after exit, whether charitable giving, volunteering or supporting other entrepreneurs through capital and mentorship to advance their ideas [Figure 2].

Russell concludes: "Purpose-driven entrepreneurs mustn't underestimate the psychological preparation needed to handle a business exit. They need to have a plan for the future, which means planning for their wealth, their family and their own next endeavour. Those are the three considerations to pay attention to, and the sooner and more comprehensively you plan, the better your chances of succeeding."

Figure 2: The next chapter for purpose could mean investing in another venture

Q: Over the last year, have you given time, money or expertise to support good causes personally or through your business activities?

Q: Thinking about the sale of your business and / or your exit, which of the following business activities do you anticipate being your core focus in the future?

Source: HSBC Private Bank, Essence of Enterprise