New report reveals a changing world of wealth for UK entrepreneurs

HSBC’s inaugural Global Entrepreneurial Wealth Report takes a deep dive into the world’s wealthy entrepreneurs, painting a comprehensive picture of the business leaders of today and tomorrow. Our research reveals their priorities and concerns, and uncovers new points of distinction between UK business owners and their peers internationally.

With proprietary research into almost 1,000 high net worth entrepreneurs across nine global markets, HSBC’s Global Entrepreneurial Wealth Report covers several key areas of focus for global entrepreneurs today. The report analyses their business and family backgrounds, their personal and professional connectivity to international markets, and looks beyond business ownership to discover when, how and why they intend to exit.

UK vs Global – A world of difference

A more focused look into the research uncovers the intricacies of business owner wealth in Britain today, revealing changing points of comparison between UK entrepreneurs and their global counterparts. We take a look at some of the key findings and summarise how UK business owners compare with their global counterparts.

- Entrepreneurialism runs in the family… or does it?

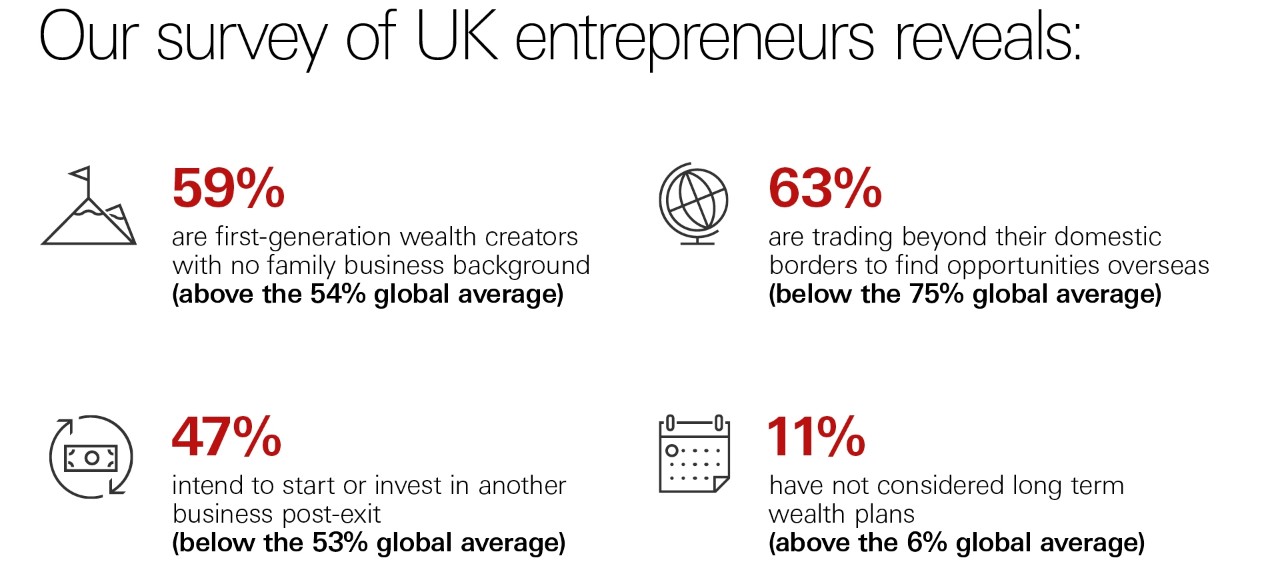

At a global level, more than half of entrepreneurs are first-generation. Overall, only 46 per cent of our respondents have a family business background. A bigger majority (54 per cent) have no family business background.

Here in the UK, the number of first-generation wealth creators is even larger at 59 per cent. In comparison, India, Switzerland and UAE all show an opposite pattern, with at least 62 per cent coming from a family business background. However, it’s mainland China that has the highest proportion of first-generation entrepreneurs, at 78 per cent.

“The global emergence of first-generation wealth extends to first-generation entrepreneurialism here in the UK as well. Our research shows that well over half of UK entrepreneurs (59 per cent) don’t have a connection to a family business, and are instead creating their own paths to wealth creation by starting companies around their interests, experiences or by capitalising on identified new opportunities.”

Jeremy Franks, Managing Director, Head of Wealth Planning and Advisory, UK and EMEA, HSBC Global Private Banking

The global emergence of first-generation wealth extends to first-generation entrepreneurialism here in the UK as well. Our research shows that well over half of UK entrepreneurs (59 per cent) don’t have a connection to a family business, and are instead creating their own paths to wealth creation by starting companies around their interests, experiences or by capitalising on identified new opportunities. - Jeremy Franks, Managing Director, Head of Wealth Planning & Advisory, UK & EMEA, HSBC Global Private Banking

- (Re)connected to the world

Overall, 75 per cent of global entrepreneurs operate businesses that are trading outside of the country they are based in, versus 25 per cent who are domestically based. At first glance, UK entrepreneurs appear more domestically focused than the global average, with 37 per cent trading only within their borders. Only the USA (at 47 per cent) is more domestically focused.

However, UK figures do reveal a significant majority (63 per cent) of UK entrepreneurs are actively trading beyond domestic borders, with 12 per cent signalling active expansion into new markets. In comparison, Hong Kong shows the biggest proportion of cross-border trading activity (96 per cent), with the highest number of entrepreneurs who are expanding into new markets (21 per cent).

Given how internationally connected global entrepreneurs are in business, you might expect their families to also be domiciled across borders. When asked how many countries do you and your family live in, 45 per cent of global entrepreneurs answered across two countries or more. UK respondents indexed slightly above the global average, with 48 per cent located across two or more countries.

“UK entrepreneurs are internationally minded and connected, but they aren’t simply in search of business opportunities abroad. The international nature of their professional and personal lives – whether it be living or relocating abroad for work or family reasons – increases their need for expert partners to achieve their goals.”

Russell Prior, Managing Director, Regional Head of Family Governance, Family Office Advisory & Philanthropy, EMEA, Wealth Planning and Advisory, HSBC Global Private Banking

- The UK’s Great Wealth Transfer begins… slowly

The Great Wealth Transfer has started at a slower pace in the UK. When asked at what point do you intend to pass on your wealth, over 51 per cent of UK respondents say they intend to start the process in later years. Other regions across the globe are more likely to have either already made formal wealth transfers, or to have already started informally helping children and grandchildren.

When asked when they intended to discuss the family wealth transfer process, 60 per cent of UK entrepreneurs said they were either already discussing, or intending to start, in the near future – which is closer to the global average (68 per cent).

“As so many UK entrepreneurs in our research are first-generation creators of wealth, many are unlikely to have any previous experience of either selling or handing down a business. To keep pace with their peers and effectively manage significant challenges and opportunities, it’s clear that more need to have considered conversations about their wealth succession plan to properly define their path to a successful exit.”

Jeremy Franks, Managing Director, Head of Wealth Planning and Advisory, UK and EMEA, HSBC Global Private Banking

- Ready to exit?

At a global level, business transitions are also on the horizon, with 34 per cent of global entrepreneurs planning on exiting their business within the next five years, and 33 per cent thinking of exiting beyond five years. UK entrepreneurs broadly mirror their global peers, with 35 per cent also planning to exit within five years, and 30 per cent beyond five years.

In comparison, Hong Kong and India business owners are most likely to exit in the next 5 years at c.45 per cent. More dramatically, in UAE 79 per cent of business owners indicated they had no current intention to exit, compared to just 35 per cent in the UK.

- How to exit?

Globally, the majority of respondents know exactly how they intend to exit. Overall, 52 per cent of global entrepreneurs intend to hand their business over to family members. 35 per cent will sell in some way, and 15 per cent have not yet considered how to exit.

However, there are notable differences by region. In the UK, a higher number (21 per cent) have yet to even consider how they will exit their business. Those who have prefer the route of succession over sale, with a smaller number than the global average (43 per cent) intending to transfer to the next generation to keep the business within their immediate family.

- Does exit equal retirement?

In the UK, when asked if they currently have any ambitions or goals in mind once they have exited their business, 47 per cent of respondents communicated they either had another business idea they would like to start, or an ambition to invest in another business, or intended to find a leading role as a CEO or mentor in another firm.

The remaining respondents would like to retire to pursue more personal interests, with only a small number of business owners (nine per cent) flagging an interest in philanthropic or charitable activities.

“A high proportion of UK entrepreneurs still want to be actively involved in other businesses or even start a new company post-exit, while others want to pursue personal interests. Understanding what you want to do post-exit is as important as the exit itself, to ensure you have the right measures in place to fully enjoy the next chapter of your journey.”

Russell Prior, Managing Director, Regional Head of Family Governance, Family Office Advisory & Philanthropy, EMEA, Wealth Planning and Advisory, HSBC Global Private Banking

A high proportion of UK entrepreneurs still want to be actively involved in other businesses or even start a new company post-exit, while others want to pursue personal interests. Understanding what you want to do post-exit is as important as the exit itself, to ensure you have the right measures in place to fully enjoy the next chapter of your journey. - Managing Director, Regional Head of Family Governance, Family Office Advisory & Philanthropy, EMEA, Wealth Planning and Advisory, HSBC Private Banking

For more in-depth international perspectives on business owner wealth, download HSBC’s Global Entrepreneurial Wealth Report.