Business Exit: The personal impact

Planning effectively for a business exit is not just about preparing for the moment of sale, it is also about planning for the life you and your family want afterwards.

Business exit is the stated end-game for a majority of business owners, with recent research suggesting that between half and two thirds hope to sell one day1. Yet an overwhelming majority do not already have succession or governance plans in place, resulting in myriad challenges further down the road.

With as many as half considering exiting as a result of issues relating to succession or the next generation, the eventual sale can become a double-edged sword for many family businesses: they should be celebrating success but instead can regret being swept up by events before having taken the time to plan properly.

Speaking at a recent networking breakfast for our clients, Russell Prior, Head of Family Governance and Family Enterprise Succession HSBC Private Banking, commented “We typically find that the drivers for the start of a business sale process break into three groups. Firstly, there are reasons relating to the business and ownership models: these can be wide-ranging, from performance issues (for example, trading isn’t great), to wanting to release capital from the business or one partner preferring to come out of the business altogether. Secondly, there’s the succession problem. Who’s going to take over the business next? And personal circumstances may come into play here too, such as divorce, poor health or just having the desire to move on to something new. Finally, there’s the sale for strategic reasons, for instance where the target sale price that you’ve set for your business has been reached, or the exit is a strategic divestment.

Having looked into these three sets of reasons, we found that a minority of owners start the business exit process for positive, strategic reasons. The majority find themselves starting the process for one or more of the other reasons, which are typically more challenging.”

To avoid “seller’s remorse” business owners should ask themselves well in advance of a sale what they want their future to look like and how the sale of the business would help them to achieve their vision.

Developing a long-term vision for family wealth

Having invested every waking hour into running their businesses, many entrepreneurs forget to step back and think about the long-term vision for their wealth before embarking on a sale. A well-thought-through wealth strategy becomes particularly important when considering selling.

“Is your vision of wealth one of ‘fruit’ or ‘timber’? Do you want the tree to flourish so that the fruit can be harvested and shared widely? Or do you prefer to cut down the tree and just consume the timber, recognising that’s it!” asked Russell.

Understanding the perspectives and impact upon other family members is the next step. Family-related goals are often the driver for a business exit, so we recommend that owners reflect upon and discuss with their spouse and children how a sale would impact their circumstances, lives and aspirations. Building family consensus doesn’t mean that everyone has to agree, but it does mean thinking through the likely cross-generation impact of a sale and taking the right steps to mitigate concerns before they can cause dissent.

This consensus can be particularly important where there is a brand or reputational risk associated with selling – such as selling a business that includes the family name or the loss of a multi-generational legacy. In these situations, the decision is likely to be even more emotionally charged. Equally, for many families the sale might be the first time that wealth becomes readily available. In these circumstances we often see that families are not ready to discuss the topic, let alone deal with the implications.

Identifying your future role

The commitment made to the running and sale of a business often leads to insufficient thought being given to what the post-sale future holds for the owner. Some have ambitious dreams and plans that involve doing the things they haven’t had time for; others identify a particular role they want to play.

This is often a more difficult choice than it appears, as there are more options at this stage than when they first started out in business. At the outset of most businesses, the founder is both the creator and owner of the business and the approach tends to be very entrepreneurial. As the business grows, owners are typically faced with the challenge of letting go of some of the control as they transition towards owner/manager, bringing on board the additional capabilities required for the business to flourish. This shift can be tough for some, who struggle to relinquish control of the business they started.

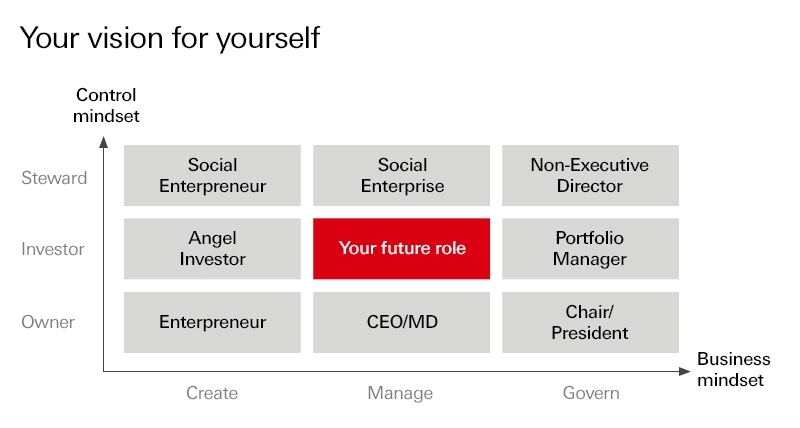

Life post-sale can offer not only the choice but also the wherewithal for owners to realise other ambitions. Yet, in reality, success will be predicated on whether the owner has the capabilities to adapt from the type of role they played in their business and whether they possess the characteristics required for the role they wish to play post-sale. The two axes shown in the table below – ‘the business mindset’ and ‘the control mindset’ – provide a useful way of thinking about this.

Entrepreneurs thinking about exit will need to identify which post-sale role (or roles) offer the best fit to their personality. Natural creators are likely to miss the adrenaline of running the show themselves too much to stay away for long and will go on to found a new business, or several, if they are a serial entrepreneur. Others may seek a different, less hands-on, kind of influence, such as mentorship and capital provision for new start-ups (angel investor). Others will seek a different kind of reward, for example by entering the non-profit space as a social entrepreneur.

For those entrepreneurs who see business exit as the chance to take a hands-off role and devote energy to other passions, a stewarding role could be tempting, allowing them to set strategic priorities at a high-level while leaving the stressful day-to-day running to the new owners and managers.

Russell noted, “If by nature you’re a manager, you might be the CEO or the MD. But if you tend towards a governance role, you might step back from the business and be the chair or president. You might become a portfolio manager or go down the non-exec director role. The point is to ask yourself: What sort of person am I? What do I want to do next?”

Safeguarding your legacy

To avoid “seller’s remorse” business owners should ask themselves well in advance of a sale what they want their future to look like and how the sale of the business would help them to achieve their vision. Once that vision has been clarified and objectives set, they will need to take steps to de-risk the sales process, such as creating a governance framework for decision-making and determining the asset structure.

For a long time, entrepreneurs will have felt that their identity has been defined by their business. Before deciding whether exiting is right for you and your business, it makes sense to step back and consider the personal impact – specifically, what ambitions you have for yourself and for your wealth. Ultimately this will help you to achieve your goals, whether that’s passing on wealth to the next generation or contributing to society more generally.

A key part of planning an exit means securing wealth for you, your family and the next generation and putting you on the path to the next opportunity.

For more information on how HSBC Private Banking can support business owners during the planning and executing of a business sale, please contact your Relationship Manager.

1HSBC Private Banking, Essence of Enterprise Report 2016, Family Business Place 2014 Family Business Survey, PWC Global Business Survey 2014 & 2016.↩