Fed holds steady but changes long term policy outlook

The Federal Reserve (Fed) did not change its near term policy outlook at its June meeting. However, it is in favour of raising rates in 2023. It seems apparent that the Fed would make a statement about tapering its quantitative easing programme sometime soon. That announcement may rile financial markets and cause participants to reprice securities in their portfolios. However, the Fed seems determined to provide the liquidity and a low rates structure to lift economic activity. As a result, we remain in a risk-on mode, with an overweight to global and US equities.

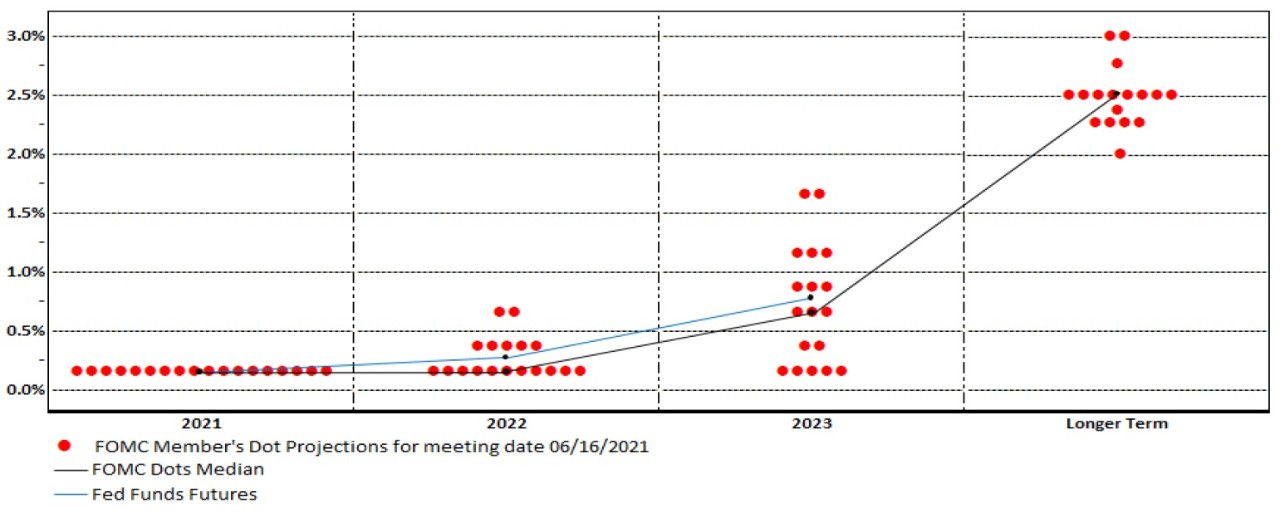

As expected, the Federal Reserve did not alter policy at its June FOMC meeting. The FOMC left the Federal funds rate unchanged in the 0.0 - 0.25 per cent range. However, given its more constructive view on economic growth, the committee did change its forecast on policy rates. They incorporated an increase of fifty basis for the Federal funds rate in 2023. The FOMC also issued new economic assumptions for the next several years. The forecast for growth was revised up to 7.0 per cent in 2021 while the assumption for inflation were revised up materially in 2021. Given that the FOMC did not lift its median forecast for PCE inflation in subsequent years, it suggests the Fed maintains a view that the acceleration in inflation remains transitory and will not become a more pervasive problem for financial markets.

The Fed's New Dot Plot After Its June 2021 Policy Meeting

Source: Federal Reserve, Bloomberg, HSBC Private Banking, 16 June 2021

Economic projections of Federal Reserve Board members and Federal Reserve Bank presidents, under their individual assumptions of projected appropriate monetary policy, June 2021

Source: Federal Reserve, Bloomberg, HSBC Private Banking, 16 June 2021

In regards to tapering the quantitative easing programme already in place, the Fed maintained its current pace of purchases of both US Treasuries and mortgage-backed securities. In the Q and A session, the Fed Chairman, Jerome Powell, did say that "we will provide advanced notice before announcing any decision to make changes to our purchases". Given this assurance, it seems that QE tapering could take months to plan and execute. As a result of the Fed's decisions today, we maintain our risk-on view with an overweight to global equities. Our overweight in the US remains in place with a focus on cyclical stocks and the consumer sector. We discuss opportunities related to these cyclical and consumer related sectors in our 'Reopening America' High Conviction Investment Theme.

For Fixed Income investors, potential tapering of quantitative easing programmes later this year or in 2022 implies that we could see a more positively sloped or a steeper yield curve in the short term. However, it is important to remember that higher Treasury yields would most probably result in increased global demand for US Treasuries. This could cap longer dated fixed income yields. For global investors, any extension of the 'lower for longer' scenario suggests that the business cycle could be extended as the structure of US rates could remain accommodative for longer than expected. In the credit markets, any modest lift in yield could be positive for demand in the corporate credit markets as well. The expansion of the current business cycle and improving economic and financial fundamentals should continue to drive the number of upgrades in corporate credit higher, as quality continues to improve. See our High Conviction Investment Themes on 'DM Financials Credit' and 'Reaching for High Yields' for investment opportunities in the Fixed Income space.

/banner-2020/HSBC-Private-Banking---Lake-ice-in-the-rays-of-the-rising-sun.jpg)