Open ended solutions

In the realm of alternative assets, fund structures have often been overlooked by investors in the past. Traditionally, private market fund vehicles have been predominantly closed-ended, aside from hedge funds. However, there’s a notable shift in manager focus towards launching open-ended fund vehicles, resembling approaches familiar in public markets and hedge funds. While these open-ended funds offer benefits for both managers and investors, they should be carefully considered alongside closed-ended vehicles, each evaluated on its own merits. HSBC Global Private Bank have been at the vanguard of this new opportunity, working with top tier private market managers.

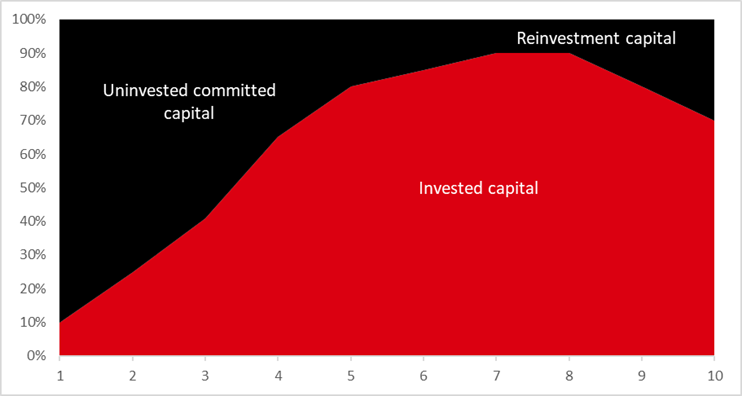

- Closed-ended: Also known as ‘drawdown vehicles’, these funds involve committing capital upfront, with investors waiting for their committed capital to be called and invested over several years. Utilizing a multi-vintage program, diversifying investment across different periods, can enhance net returns while mitigating risks for investors.

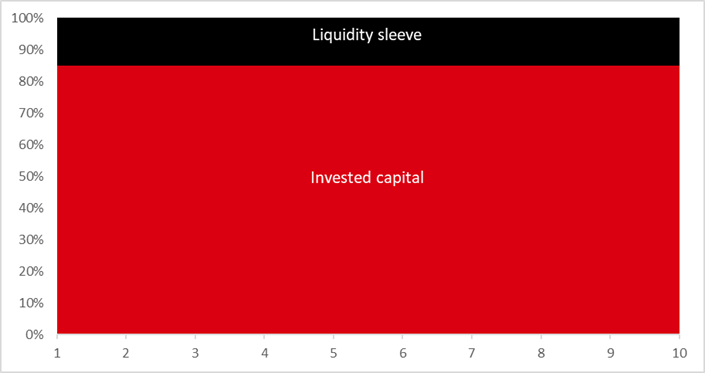

- Open-ended: Referred to as ‘evergreen vehicles’, these funds don’t have a fixed term and continue indefinitely. Investors can stay invested for a duration that suits them, with underlying investments typically priced on a monthly basis to balance interests of both buyers and sellers.

In this landscape, execution is crucial, and manager selection is paramount. With significant dispersion between successful and unsuccessful funds, choosing the right manager can lead to outsized returns compared to peers.

Our offering

We’re excited to offer open-ended solutions as an alternative route to accessing the benefits of alternative investments. These solutions provide direct access to the asset class in an evergreen format, eliminating capital calls and offering clients greater visibility and control over their portfolios. This instant deployment also provides return benefits when compounding over time. With lower minimum investment requirements compared to traditional private market solutions, clients can construct diversified portfolios of open-ended solutions to complement their existing investments. Open-ended solutions offer private wealth investors a relatively efficient and straightforward way to access private markets.

We provide solutions tailored to meet our clients’ preferences, investment knowledge, and requirements, spanning both closed and open-ended structures across private markets.

To learn more about our solutions, please contact your Relationship Manager.

/banner-2023/HSBC%20Global%20Private%20Banking%20-%20Footbridge%20with%20red%20neon%20effect.jpg)